Are you victim of identity theft? Received a 5071C letter from the IRS?

Get a better understanding of what the IRS has found and what they want you to do. As a practicing tax professional, NTTS teaches how to handle and manage IRS and tax related issues. Click here to learn more about our Federal Tax Courses.

Listen Now:

Transcript:

Identity theft! The mere thought of that problem is upsetting. Couple that with a dreaded letter from the IRS that you quickly peruse and it could become frightening. You take a deep breath and you take a second look at the letter that you received from the IRS to get a better understanding of what the IRS has found and what they want you to do.

The IRS was more proactive this filing year season than they were in the past. They reviewed many more returns before they were actually filed and processed, especially those that did not make sense to them based on past years. The IRS generated different types of letters to taxpayers, asking them either for information, verification, letting them know there was something wrong with the filed return they received, and each one of these letters requires a different type of response. It is important when dealing with the IRS to respond to the type of letter that they request of you.

In many situations, you would receive a letter from the ICO Rejects. What the heck does that mean? It’s not so simple to figure out but it is one of their departments that reviews a return and something doesn’t make sense and they have a reject notice, and they send you information. It could be as much as leaving out a schedule on the return. It could be because the information they received did not make sense. It could be for some reason some of the information on the return did not match, like the wife’s Social Security did not match what was on the filed return.

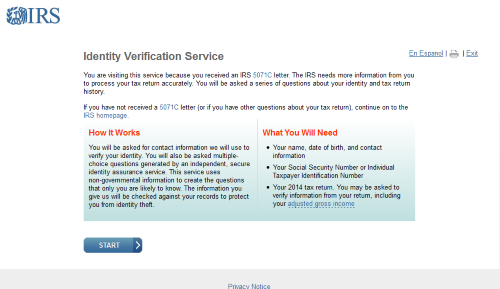

Other types of letters will just ask you to go online and I.D. verify. Go on the I.D. Verify website, which requires that you go in as the taxpayer and answer a number of questions. A representative normally cannot go on this I.D. Verify website because the types of questions asked by the IRS on this I.D. Verify site deal with personal-type questions that probably only the taxpayer himself or herself knows the answer to. Therefore, if one of your clients receives a letter asking them on the I.D. Verify website, I would recommend that you tell them to go on the website. It takes only a few minutes. It’s open 24/7 and they can verify the information. The IRS can proceed in processing or not processing the return that they received.

There are times when you would get a letter from the IRS, indicating that the return was filed and that you are now filing a duplicate return, an amended return, and of course, if you haven’t filed a return, somebody has filed a return for you. Occasionally the return that was filed for you could be a filing by a wife, separately from yours; could be a filing by a child or other dependent who is claiming themselves on their return. Many of these rejects require additional research to figure out what happened and why was the return rejected.

If a client gets a letter, it’s important to take a look at what the letter says, what the IRS is requesting, and then responding as soon as possible to the IRS with the information that they ask for. Occasionally it’s a copy of your return that you did file and someone else is using the information to file another return. Then you would send a copy of the return with the letter that they sent to you.

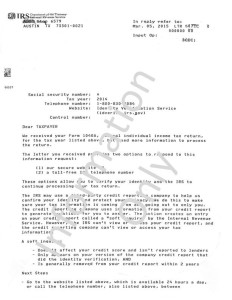

Occasionally the letter, as some people look at it and say, “I never file in that service center. Why are they sending me this notice?” There are only certain service centers that will process identity theft cases, and therefore don’t look at that letter from the service center as being something suspicious. If it is suspicious to you, you could always call the IRS and ask information. The phone number’s usually on the letter. Call them up and ask them to verify. Again, if you are the representative without a power-of-attorney, they will not talk to you. Maybe give you a generic response, but that’s about it.

There’s also been a recent rise in the number of tax fraud cases and the IRS has cautioned people to be wary of this type of communication. Phone calls, texts, and emails threatening or leaving voice-mail messages claiming that it’s urgent to you to respond to them, has also proven to be phone scams that scare the public. One thing that needs to be pointed out is there are certain things the IRS will never ask of you on the phone. They won’t call you and tell you or send you a bill without sending you previous communication. They won’t threaten you with arrest or warrants or law enforcement or intimidate you to pay the bill. They won’t ask you to pay the bill over the phone, and they will not require you to pay it a specific way, to pay it by credit card, by check, by cash. They won’t tell you a specific method. They will never tell you that you do not have the rights to appeal any of the tax bills.

These are some of the identification items that will point to you this is a phone scam and you should not respond to it. You could report it to the IRS at 1-800-829-1040 or file it with TIGTA, Treasury Inspector General for Tax Administration, either on the phone, 1-800-366-4484, or on their website treasury.gov/tigta